By JAC Homes

•

July 4, 2024

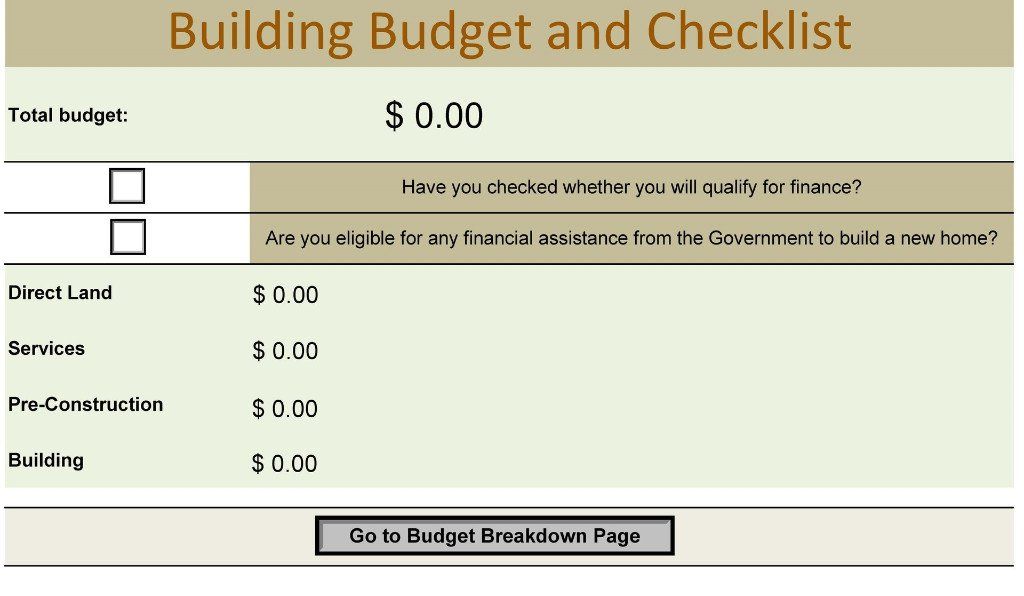

With housing prices soaring, backyard granny flats are becoming increasingly popular as cost-effective property additions and attractive long-term investments. 1 2 These secondary dwellings, designed for extra space or guest accommodation, cater to various lifestyle requirements while offering rental income opportunities. 3 2 From intergenerational living solutions for aging family members to home offices or granny flat designs for catering to specific needs, building a granny flat presents numerous cost-effective solutions. 3 2 Whether seeking budget considerations for maintaining independence or exploring ways to increase property value, this comprehensive guide explores the benefits, considerations, and process of constructing a backyard granny flat. 2 Rising Popularity of Granny Flats The concept of granny flats, dating back several centuries to what was historically known as the "dowager house", has experienced a modern resurgence, particularly in Australia. 4 Originally, the dowager house served as a separate residence of an English, Scottish, Welsh, or Irish estate, designated for the widow of the estate owner after the passing of her spouse. 4 This arrangement ensured the widow could remain close to family and within familiar surroundings after the estate's heir assumed control of the primary property. 4 The term "granny flat", believed to have originated in Australia, embodies a similar concept to the dowager house, providing housing primarily for aging family members, affectionately known as "grannies". 4 5 Factors Behind the Trend With the escalating cost of living, dual living arrangements and granny flats have garnered unprecedented interest among Australians and offer practical and affordable solutions in response to the evolving needs of families and aging individuals. 4 There are plenty of reasons for the granny flat's popularity, and it's not just because they're a great way to house grandparents. 6 One of the best things about granny flats is that they can provide a great source of extra income. 6 With the rising living costs, renting out a granny flat can ease the financial burden. 6 Granny flats can provide additional income, but they can also be a great way to house elderly relatives or perhaps even adult children saving for their own home. 6 One of the key reasons more people are now interested in granny flats is that they offer an excellent long-term investment. 6 Adding a granny flat to your property could increase the value of your home. 6 This makes financial sense, but it also means that you will have a valuable asset to rent out in the future. 6 Another main reason why granny flats are becoming increasingly popular is that they offer an affordable option for first-home buyers. 6 A granny flat can be built on your property for a fraction of the cost of a traditional home, making it an excellent choice for those trying to get into the housing market, like your adult children. 6 According to a 2017 Demographia survey, Sydney's housing market is the second least affordable in the world. 7 That's because house prices here are almost 13 times higher than the median household income. 7 Add the fact that rental yields in Sydney are already low, and it's easy to see why property owners are reluctant to make costly renovations. 7 Instead, many of them choose to build a granny flat to boost the value of their property. 7 As a result, this type of housing has seen a major boom in recent years. 7 What is a Granny Flat? A granny flat is a second dwelling that typically accommodates one or two people, usually sharing a property with a main house. 8 8 Both the granny flat and the main dwelling fall under the same title. Granny flats provide living space for family members or can be rented out to tenants. 8 8 Definition and Types "Granny Flat" is a colloquial term for "accessory dwelling unit" (ADU) or what some councils call a detached dwelling or auxiliary/secondary dwelling. 9 9 You may also know them as small homes, tiny homes, guest houses, or mother-in-law quarters. They are essentially small flats built on a property or block of land that someone already owns, with their own entrances, bedrooms, kitchens, and bathrooms. 9 9 A granny flat is considered a secondary dwelling, and the two terms are sometimes used interchangeably. 8 A secondary dwelling is a self-contained unit located on the same land as the main house, including a kitchen, bathrooms, and bedrooms, and can be rented out to tenants. 8 Typically, there are three types of granny flats: 9 9 In-home: The easiest type to construct, as the only construction is within the existing house. The space for the granny flat is made completely inaccessible from the main area, except through a separate door. Home-extension: As the name suggests, this involves building upon the existing home, generally by adding an additional floor for the entire granny flat. Detached: The most popular type, providing a completely separate living space from the main house with no adjoining walls, offering complete privacy. Though called a granny flat and often used for elder relatives, these dwellings are also used for teenage family members, adult children saving for their own home, guests, or for renting out to tenants. 8 Benefits of Building a Granny Flat Living in a granny flat can be more affordable than living in a traditional home or apartment as they're smaller and require less maintenance and cleaning, which can also mean lower utility costs. 10 Cost Savings As the cost of living skyrockets, granny flats are becoming a favored living arrangement for older Aussies seeking comfort and proximity to family without the hefty price tag of retirement living. 11 11 For many older Australians, the cost of entry into a retirement village is too high, and even if it is possible, it leaves nothing left for ongoing living expenses, travel, or anything else. 11 A granny flat provides a comfortable living space close by for a fraction of the price of other options. 11 11 Family Bonding One major advantage of granny flats is that they are ideal for elder relatives but also young families or couples looking to gain their independence while still being close to family. 10 Granny flats keep the family together, with parents helping the young couple and being looked after in old age, maintaining the bond between family and elders. 12 Many Australian residents choose to provide a home for their elderly family members in the granny flat, giving them the option of caring for their elderly family member without the inconvenience of sharing the main home. 12 Some families choose to provide shelter to their teenage children by giving them the granny flat while attending university, allowing them to live independently without going too far from home or paying rent. 12 Granny flats can provide a unique living arrangement enjoyed by multiple generations, with adult children enjoying privacy while being close by to provide assistance if needed, and grandparents relishing quality time with grandkids. 13 Safety and Independence Living in a granny flat gives older parents the best of both worlds - they can maintain their independence but are still in close proximity to the rest of the family. 11 11 Having a self-contained granny flat can improve the privacy and security of the home, as each dwelling is separately accessible, and someone will be home most of the time, deterring potential thieves. 14 The recent pandemic has also raised concerns over communal living spaces, and for families wary about health safety, granny flats offer peace of mind. 11 Beyond familial advantages, granny flats play a pivotal role in overcoming social isolation among the elderly by offering a secure and comfortable living environment tailor-made for aging. 13 Considerations Before Building The size of the average granny flat typically ranges from 35 to 70 square meters, in line with local regulations and zoning laws that often specify maximum allowable sizes. 15 However, the specific size may vary depending on factors like the property's available space, local building codes, and the homeowner's or investor's preferences. 15 16 Spatial Requirements When planning the granny flat size, it's crucial to analyze the living areas your household needs while complying with council limits, typically 60-90 square meters maximum total floor area. 17 A single-bedroom granny flat may only require 40 square meters, including a compact bathroom, bedroom, living/dining space, and basic kitchenette, while multi-bedroom dwellings will need more floor area to accommodate extra bedrooms, additional living space, and living zones. 17 However, avoid exceeding the council's maximum allowable size thresholds, which can require extra planning approvals. 17 Careful space planning is essential to maximize functional, livable layouts within the permitted size guidelines for your local area. 17 The granny flat's internal layout should be tailored to suit the occupants' living needs, with clear dedicated zones for key functions. 17 The bedroom(s) and living/lounge areas are typically top priorities, followed by the kitchenette and bathroom spaces. 17 Consider incorporating one or two bedrooms depending on space and needs, and allow adequate room for furnishings, storage solutions, and circulation space within the rooms. 17 Expert architects can help optimize functional layouts that maximize livability while meeting council regulations. 17 Accessibility and Lifestyle Needs It's vital to carefully plan the doorway and hallway access between the granny flat's internal spaces and access to/from outside areas. 17 Aim to achieve direct outdoor access from the granny flat without needing to cross through the main house if site conditions allow. 17 Easy, step-free entry points for vehicles, pedestrians, and those with mobility limitations are essential. 17 Required pathways for accessing the granny flat from the street may also impact the potential layouts. 17 Discuss options for providing independent driveway access to the granny flat with the council early on. 17 Determine if a granny flat is the right fit for you and your property, and carefully consider your local council's regulations and requirements. 16 16 Consider any future needs and lifestyle changes, such as accommodating aging parents or adult children, as it may be more cost-effective to build a larger granny flat upfront than to plan renovations later. 16 16 The local climate and weather patterns can also impact the design of your flat, for example, a well-insulated granny flat may be more suitable for colder climates. 16 16 Budget Planning The size of your granny flat is a critical consideration that significantly impacts the overall cost of the project. 15 Whether you're envisioning a cozy 1-bedroom granny flat or a more spacious 3-bedroom unit, various factors such as site costs, design complexity, approvals, build price, and standard inclusions will differ. 15 Carefully assess your needs and goals to determine the optimal size for your granny flat, striking the right balance between functionality and budget. 15 Your choice of foundation material and type can also have a substantial impact on the cost of building your granny flat. 15 For instance, a concrete slab foundation is typically more cost-effective for flat sites, while bearers and joists might be necessary for sloping terrain. 15 By evaluating your property's topography and consulting with experts, you can make an informed decision that not only ensures stability but also manages costs effectively. 15 When budgeting, consider additional expenses beyond the granny flat's construction costs, such as landscaping, furnishing, or marketing for tenants. 16 It's always a smart idea to set aside extra funds for unexpected expenses or changes to the plan, with a 10% contingency budget being a good rule of thumb. 16 Conclusion The decision to build a granny flat can be a wise investment that offers both practical and financial benefits. As housing costs continue to rise, these secondary dwellings provide a cost-effective solution for accommodating family members, generating rental income, or increasing property value. With their versatility and potential for multigenerational living, granny flats can strengthen family bonds while promoting independence and privacy. In considering this endeavor, it is crucial to carefully evaluate factors such as spatial requirements, accessibility needs, and budgetary constraints. By thoughtfully planning and adhering to local regulations, homeowners can create a functional and efficient living space tailored to their specific circumstances. While navigating the process may present challenges, the rewards of a well-designed granny flat can positively impact the lives of families and individuals for years to come. FAQs 1. What are the financial benefits of constructing a granny flat? Constructing a granny flat can enhance the cash flow from your property by providing additional rental income, which can improve your financial standing with lenders. However, it's important to note that while it increases immediate yield, it might affect long-term capital growth. 2. How does adding a granny flat impact the value of a property? Adding a granny flat can typically increase your property's value by about 20 to 30 percent of the granny flat's construction cost. This value boost is largely due to the added convenience of having a separate, self-contained living space for guests, family members, a home office, or tenants, which can generate additional income. 3. What are some potential drawbacks of building a granny flat? While granny flats are cost-effective and require less upkeep than larger homes, there are some disadvantages. For instance, granny flats cannot be subdivided, the approval process for construction can be lengthy and complex, and they generally offer less storage space. 4. What is an alternative to building a granny flat? An alternative to a granny flat is a tiny house, which may be more affordable and quicker to construct. Opting for a custom-designed tiny house allows for personalization to better meet the specific needs and preferences of your family members, especially considering mobility and space utilization. References [1] - https://propertyupdate.com.au/building-granny-flat-make-good-investment-sense/ [2] - https://www.backyardgrannys.com.au/news/granny-flat-australia/ [3] - https://www.backyardgrannys.com.au/news/granny-flat-investment-guide/ [4] - https://attwoodmarshall.com.au/the-rise-in-popularity-of-granny-flats-why-you-need-a-granny-flat-agreement/ [5] - https://guides.dss.gov.au/social-security-guide/4/6/4/50 [6] - https://kinghomesnsw.com.au/why-are-granny-flats-becoming-so-popular/ [7] - https://www.archistar.ai/blog/academy-archistar-ai-the-rise-of-the-granny-flat-and-how-one-man-used-them-to-help-secure-his-financial-future/ [8] - https://grannyflatsolutions.com.au/all-you-need-to-know-about-granny-flats/ [9] - https://popuphomes.com.au/granny-flats/ [10] - https://www.backyardgrannys.com.au/news/pros-and-cons-of-living-in-a-granny-flat/ [11] - https://www.nestegg.com.au/invest-money/property/granny-flats-become-aussie-families-cost-effective-solution-to-soaring-living-costs [12] - https://i-build.com.au/the-benefits-of-adding-a-granny-flat-to-your-backyard/ [13] - https://www.downsizing.com.au/news/1387/granny-flats-a-potential-win-win-win-solution [14] - https://www.everydayhomes.com.au/news/5-Reasons-a-Granny-Flat-is-a-Great-Family-Investment [15] - https://visionpf.com.au/building-a-granny-flat/ [16] - https://grannyflatsolutions.com.au/guide-to-building-granny-flat-nsw/ [17] - https://www.aaronsoutdoor.com.au/build-a-granny-flat-in-australia/